March 2020 was a month unlike any other for the airline industry. Within a few days, domestic and international flights were grounded as governments around the world tried to limit the spread of COVID-19. While we don’t know exactly how long flight restrictions will last, we do know that the airline industry will recover eventually, as it has done through major social and economic disruptions in the past.

While it is expected that it will take at least 12 months for the aviation industry to recover fully, most experts believe the first steps to restart and recovery will be done within a few months. Industry experts frame the planning stages in response to COVID-19 as “Crisis, Restart, Recovery, New Normal”. While we are still in the event Crisis stage, airlines can begin strategizing their “Restart” plan to return capacity to the market. Airlines will need to make decisions on returning capacity with virtually no historical data on which to rely, rendering useless previous methods of planning and analysis.

EveryMundo is offering airlines a series of Restart & Re-Acquire Playbooks that provide insight into user demand, optimal pricing, and fare marketing to Restart and Recover more effectively. These guides cover some of the following key topics:

- Assessing on which routes to add capacity, how much, what frequency, and how quickly

- Reacting to the ever-changing market-by-market environments as COVID-19 numbers, practices, and regulations change

- Determining how to set and manage fares without traditional demand data and willingness-to-pay tools

Use Real-Time Route Demand to Improve Network Planning

Strategic network planning post-crisis can not rely on the usual sophisticated tools for route planning and pricing because those tools depend on historical data and traditional demand cues for optimization. When the Restart commences, airlines will be flying blind (no pun intended), because historical data will not shed light on market-by-market demand and willingness to pay. In order to overcome this, EveryMundo has introduced alternative data tools to enable airlines to gauge real-time demand on a route level during this highly dynamic period. These tools will help airlines better understand the fluctuations in consumer demand and the needs of their customers, particularly in the context of their local markets.

Read the Understand Demand Playbook for an overview of key information designed to improve demand predictions and network planning

User search data can be used as a decision making tool for network planning, by determining which routes to reopen according to traveler interest. This enables airlines to identify their most strategic routes in real-time and understand the gap between search volume and load factor in order to identify opportunities for fare adjustments.

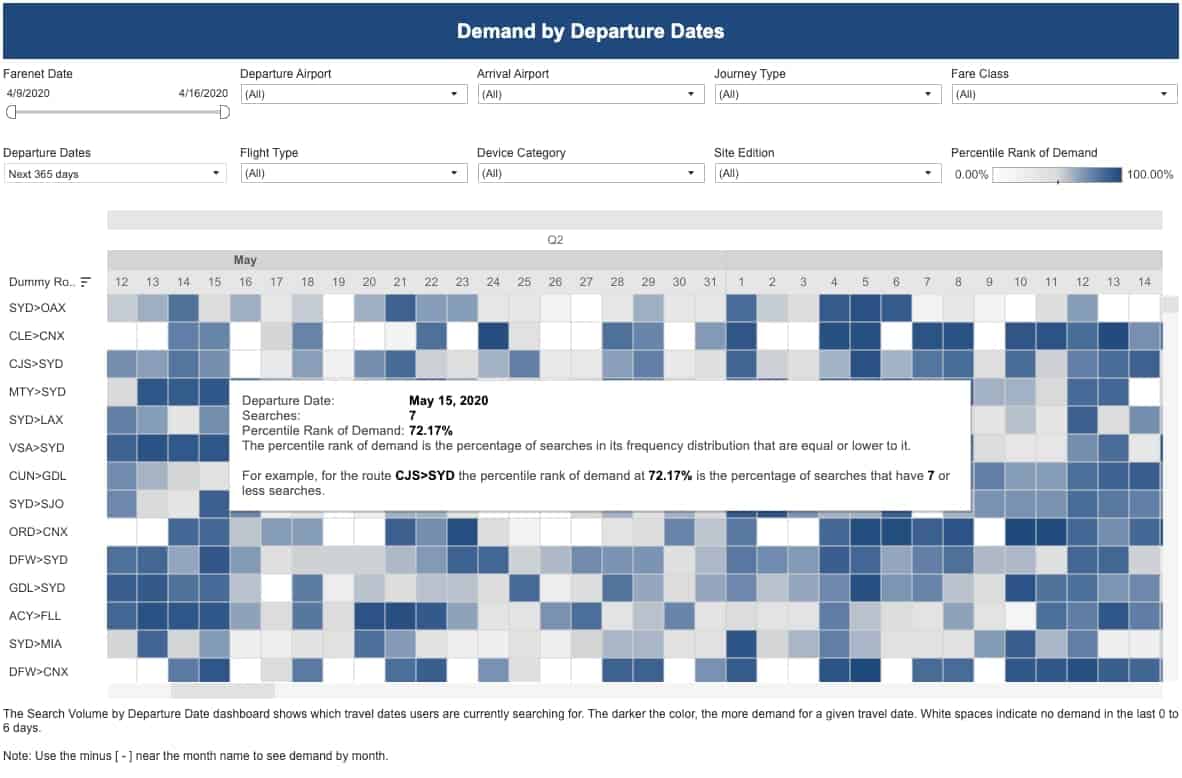

FareNet Demand by Departure Date Dashboard

The FareNet Demand by Departure Date Dashboard shows the number of search volume by route and day in the next 365 days. This is a decision making tool for network planning, reopening routes and increasing frequencies of existing routes based on the users interest. Airlines can use this information to plan which route to focus on marketing and reopening first as they are the most likely flights to sell tickets.

Daily Demand Dashboard will help airlines identify by route and market when their customers are planning their future trips. Read More >

FareNet Global Flight Demand Dashboard

EveryMundo published the Flight Demand Tracker, to provide airlines insight every day on flight demand changes by region and country. This data comes from anonymous user search data data from more than 40 airlines worldwide and is updated in real-time. Airlines can use this dashboard to see where demand is going down, plateauing, and beginning to rebound and decide route planning and marketing strategies, a different perspective from the traditional demand data.

View the Flight Demand Tracker >

Communicate Route Updates and Policies Efficiently

As airlines utilize these real-time demand tools to determine which routes are most in demand, and therefore more likely to sell tickets, they can focus their resources on marketing those routes. The airline playbook for sales of a newly launched route usually requires heavy media expenditure in the strategic markets, upper-funnel online advertising, and distribution. However, in this time, re-opening previously flown routes and increasing frequencies will require more immediate, cost-effective tactics meant to minimize media spend and drive direct channel sales to avoid higher cost distribution channels. Airlines will need to invest in performance direct marketing like SEM and email to ensure maximum load factor at the lowest cost possible. This includes reviewing prior cost of sales targets. Most sales during the Restart will be incremental.

Read the Reopen Routes Playbook for an in-depth look at how to drive direct sales for reopened routes

At this point communication with customers is essential, with shifting route operations, new travel policies, and other important information changing each day. During the Restart Phase after a crisis, airlines have the responsibility of keeping customers informed about policy changes, shifting flight schedules, and new safety practices. If done properly, the airline can leverage this channel to rebuild trust in air travel, heal customer psychology, and reinvigorate its customer base. These communications are more than the usual formality that they were pre-crisis; they are a marketing tool, and should be managed with the care that marketing messaging usually entails.

Read the Inform your Customers Playbook for our tactics on streamlining customer communications

Acquiring (or re-acquiring) customers

As demand returns, airlines can take steps to capture that demand and also induce its continued growth. Attractive fares will be critical to do this. By marketing their lowest available fares, airlines can enhance their digital acquisition and return to direct marketing and digital advertising. Airlines must behave like a true retailer by promoting offers and pushing for transactions. This will mean customer re-acquisition, even for historically loyal customers. Airlines, both big and small, will need to compete with each other and OTAs for acquiring and re-acquiring customers.

Read the Re-Acquiring Customers Playbook for tactics to increase loyalty for both new and returning customers

Customer loyalty will be tested if fares are not competitive and easy to find. Airlines of all sizes that use this opportunity to optimize their fare marketing will expand their passenger base and induce an influx of transactions as soon as routes reopen. Low-cost carriers (LCCs) may be able to capture business travel market share from full-service carriers (FSCs) as companies become more cost-conscious. FSCs may be able to capture leisure travel market share from LCCs by offering comparably low fares.

Incentivize Transactions with Deals & Promotions

Historically, deals & offers were tactical tools to unload distressed inventory. During the Restart Phase after a crisis, all inventory is effectively distressed, demand is light, and all routes are new. Therefore, all fares will seem like “deals & offers” and should be promoted as special offers to entice customers to make purchases. This is an opportunity for airlines to reclaim customers from OTAs by offering highly competitive fares, broadcasting those fares to the market effectively, and providing a low-friction user experience for rapid purchase. Every transaction counts and fares will be the deciding factor more than ever.

Read the Promoting Deals & Offers Playbook for an overview of how real-time Fare Marketing across digital channels can drive traffic and direct sales

In the coming months, airlines will set fares at aggressively low levels in order to entice passengers to begin flying again and to heal passenger psychology regarding the anxiety and perceived health risks of air travel. In the next 2-4 months airlines have the opportunity to hone their customer acquisition strategy, reduce their dependence on OTAs for sales, and develop cost-effective ways to manage their digital Fare Marketing to successfully recover after COVID-19 and come out the better for it. Without a comprehensive fare marketing infrastructure in place, airlines will struggle to re-acquire customers and sacrifice even more direct business.

Getting full planes back in the sky

Overall, every airline has a chance to set itself on an improved course: more precise customer acquisition, less dependency on OTAs for sales, more cost-effective ways to manage and evolve its digital toolkit for acquiring customers. Airlines can capitalize on this opportunity with a renewed emphasis on precision and cost-effectiveness. No airline will return to the market with the luxury to spend large budgets on digital marketing that results in poor performing campaigns. Every dollar spent on digital marketing needs to produce optimal conversions and direct revenue. To do this, airlines must have a proper arsenal of Fare Marketing tools and strategies to execute customer acquisition with precision and cost-effectiveness.

For more information reach out to your Customer Success Manager at [email protected] or, if you are not a customer, request additional information from [email protected]