airSEM Product Overview

Value of SEM (Search Engine Marketing) Channel

Performance Oriented

Brand Awareness

Represents 30-40% of total revenue

Measurable

Airline-specific SEM

Based on demand

airSEM: Airline-specific, best-in-class SEM technology

EveryMundo’s powerful combination helps airlines get the most out of SEM. airSEM is comprised of several SEM tools that are designed to optimize SEM campaigns and strategies. airSEM Product Page >

- Automated Tools: Airline-specific SEM automation technology to build, manage, optimize, and monitor global airline SEM

- Implementation of airDPI – Dynamic Price Insertion

- Implementation of airOptimizer (bidding management)

- Fast campaign creation with airBLDR.

- Controlled Experiments: Ongoing trials to test incremental SEM account improvement

- Performance Expertise: Partner with global airline SEM experts to learn advanced SEM – build institutional knowledge

- Automated Reporting: Track all performance in real-time to secure ROI targets

- Assessment of old campaigns and share findings with next steps

- Review and adjust of Conversion Tracking

- Generation of Messaging Strategy in all languages

- Build out of multiple Brand and Nonbrand campaigns in multiple languages

- Audiences Creation

- Manage and implementation of promotions with airPROMO

- Optimization of new campaigns

Brand SEM vs. Non-Brand SEM

What SEM Brand and Non-Brand can and can’t do

Brand SEM Protects your Brand

Brand SEM basically brand insurance. The user knows exactly who they are looking for, but Google makes it possible for OTAs and competitors to swoop in last minute and steal loyal customers, so they charge “insurance” to the brand to ensure the last click comes to you.

Branded keywords are keywords used to search for an airline name, these can include typos, variations, etc.

There are many benefits of bidding for your brand name:

- Avoid competitor’s stealing market share

- CPCs are usually 70% lower than non-brand keywords

- Increases MKT presence for returning customers

- Custom messaging strategy

Brand SEM

Can Do:

- Brand Protection

- Improve Quality Score

- More visibility

- Control the message

Can’t Do:

- Acquire new customers

- Capture generic terms

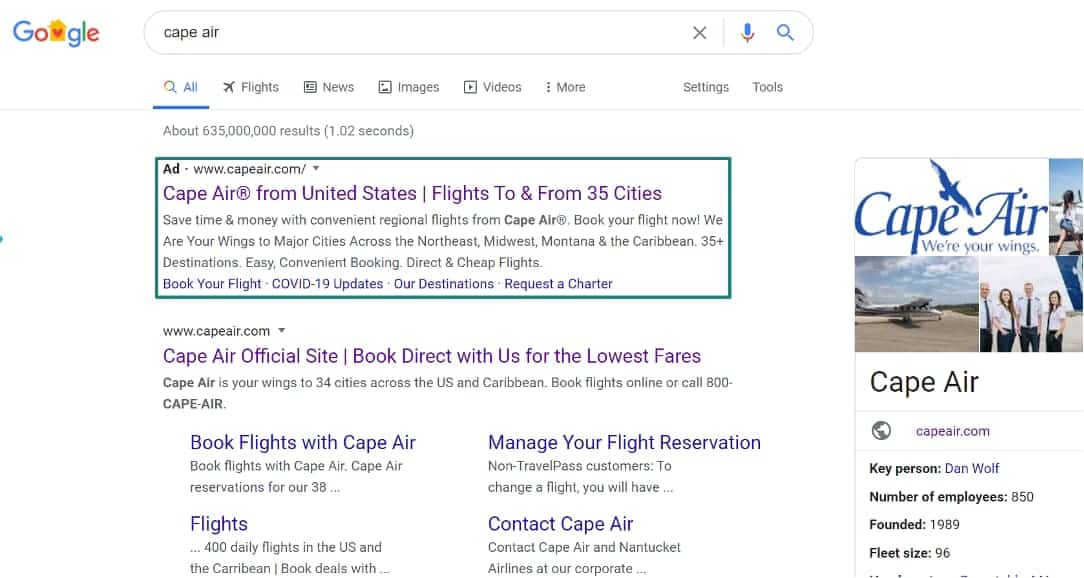

Example of branded keywords for “Cape Air”

- Modifiers: “Cape air deals” “www cape air”

- Misspellings: “cape aer”

- Core: “Cape air”

Non-Brand SEM enables Customer Acquisition

Non-brand SEM is incremental new customer acquisition – non-loyal customers expressing open-mindedness regarding the carrier they choose. Therefore, lifetime value needs to be considered, at least conceptually, when managing targets here.

Airlines should be on every O&D they fly first and foremost, then expand to more generic (but geotargeted) destination keywords if the CoS targets tolerate it.

The reason is to work from the bottom up in terms of CPC and competitiveness to ensure the revenue generated via SEM is as low-cost as possible, and therefore optimized.

Non branded terms are used capture new customers and incremental revenue from down-of-the-buying-funnel users. That is why non-branded terms have higher competition and have a more expensive CPC.

We can capture users searching for:

- Specific Routes

- Specific Destinations

- Acquire New Users

Non-Brand SEM

Can Do:

- Capture demand

- Acquire new customers

- Brand awareness & loyalty

- Capture undecided users

Can’t Do:

- Generate demand

- Get full credit on last-click attribution model

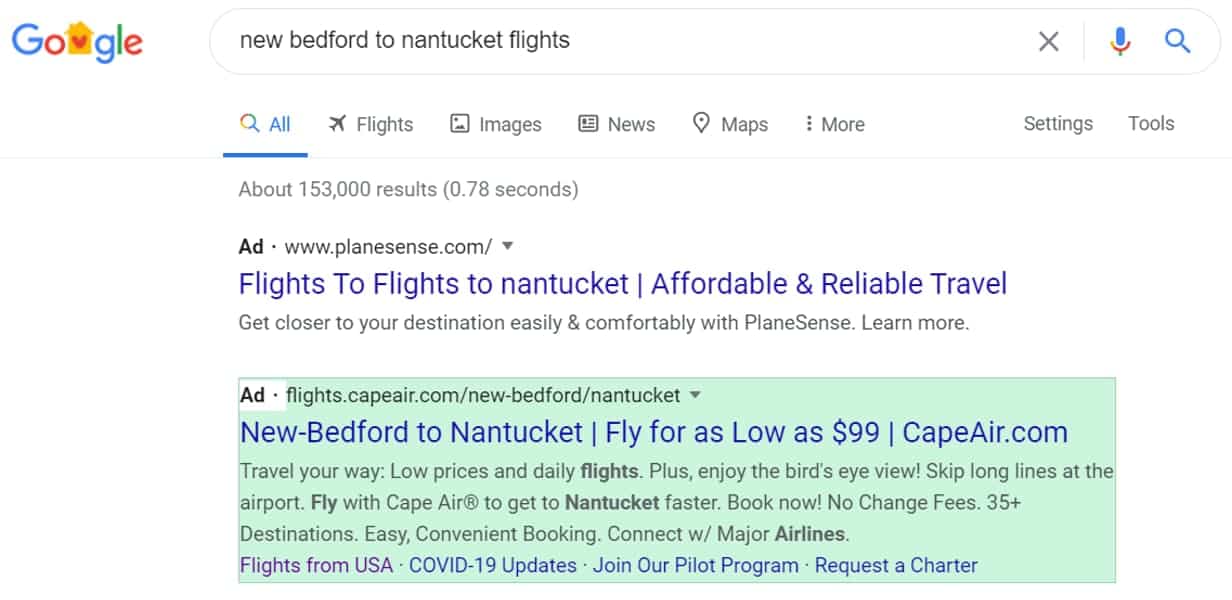

Example of Non-branded keywords for “Cape Air”

- Routes in their network: “new bedford to nantucket”

- Destinations in their network: “flights to nantucket”

KPIs: Cost of Sale (CoS)

We suggest using CoS (spend / revenue) KPI since enables comparison of routes in a normalized way, and comparison to indirect channels as well, i.e. commissions + GDS fees. Airlines can pursue a fixed revenue target while attempting to minimize spend. A fixed CoS with freedom to spend as much as possible while staying below that CoS (and therefore maximizing revenue)

Incremental value is incredibly hard to identify. We approach this by assessing:

- Competition by route

- Load factors

- Level of loyalty or brand penetration in a given market

- Other available indicators to estimate if an airline should be willing to pay a higher CoS for a given sale due to increased expected incrementality.

Our airlines will use last paid click attribution (standard in Google Ads), generally target a blended CoS that approximates the CoS of an OTA sale (commission + GDS fees), and sometimes add a slight premium due to the potential of additional lifetime value / lower subsequent acquisition cost of a direct channel customer acquisition.

Industry Benchmarks

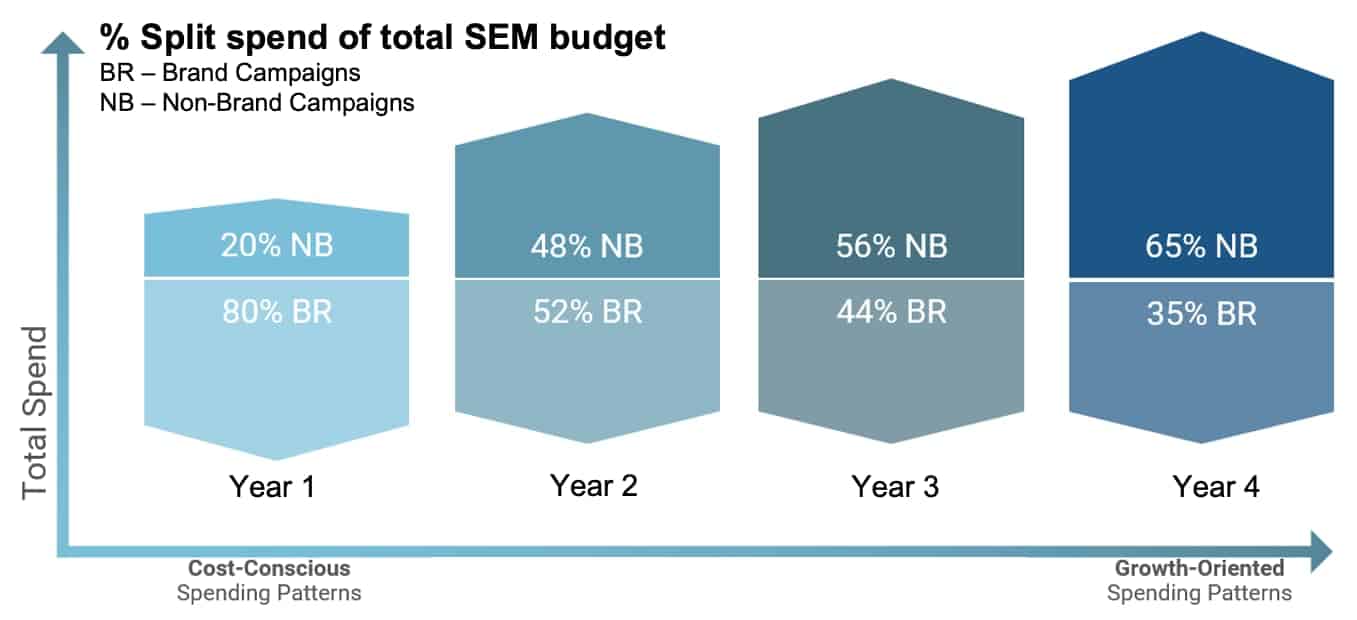

In the industry there is two main types of strategies that an airline can follow:

- Cost-Conscious: the strategy is oriented to Brand efforts.

- Growth-Oriented: the goal is to achieve new user through Non-Brand efforts.

Cost-conscious Strategy

1.0M to 2.0M Annual Spend

% Spend

- Brand: 70% – 80%

- Non-Brand: 20% – 30%

CoS

- Brand: 0.5% – 1.5%

- Non-Brand: 5.0% – 15.0%

- Overall: 1.0% – 2.0%

CPA

- Brand: $1 – $3

- Non-Brand: $5 – $10

- Overall: $3 – $10

Cost-conscious Strategy

+2.0M Annual Spend

% Spend

- Brand: 30% – 40%

- Non-Brand: 60% – 70%

CoS

- Brand: 0.8% – 1.5%

- Non-Brand: 15.0% – 25.0%

- Overall: 2.0% – 4.0%

CPA

- Brand: $5 – $9

- Non-Brand: $30 – $90

- Overall: $11 – $22

Channel shift from indirect to direct sales

EveryMundo works with its airline partners to acquire incremental revenue via Non-Brand Paid Search to increase search market share, while optimizing the cost of customer acquisition.